We live in an era where the new age full stack insurer Lemonade competes against heavyweights like Allstate and State Farm. If we look further Eastwards towards India, the insurance aggregator Policybazaar faces off against established agents and Bancassurance. All made possible as insurance buyers place a premium on the convenience, transparency, and cost savings that these disruptive entrants bring to the table. The onus is on insurers to establish innovative hybrid distribution models that stand up to demanding customer preferences.

Hybrid insurance distribution models are essential for insurers to stay ahead of the competition. To start with, the holistic combination of physical and digital distribution channels extends network reach. It enhances each interaction and enables customers to select channels of their choice across the policy lifecycle. Modern insurers can leverage the power of agents, end-to-end automation, and mobile apps to deliver outstanding customer experiences that quickly close policy sales with hybrid distribution models.

Hybrid Distribution bugbears

Improperly implemented hybrid distribution models present multiple bottlenecks for insurers. To start with, inconsistent customer experiences and lagging distributor productivity across channels are common issues in hybrid insurance distribution models. This is often due to the varying processes, insufficient integration, and information availability across channels.

For example, there can be communication issues when a prospect moves from initial chatbot interactions to an in-person meeting with an agent. Non-conformities due to different systems and insufficient data sharing between channels often create such sales opportunity losses. Or it can be in the form of claims processing issues which involve physical surveyors and automated approvals. Such complications can detrimentally affect a distributor’s confidence in the insurer.

Product personalization is another area where hybrid models can face challenges. Customers expect custom-made products and recommendations which can be either online or recommended by their agents. Distributors must have access to advanced analytics and recommendation options to cater to these demands. Or policyholders may demand seamless policy modifications with self-service options. System silos between channels can impair such efforts and affect stickiness.

Recruitment and motivation of key producers is a critical challenge for insurers, especially for companies that lack a unified distribution management platform. The diverse mix of distribution stakeholders across channels further complicates the landscape in many insurance markets, affecting future business roadmaps. Extensive business insights are essential to achieving these objectives, which ad-hoc hybrid distribution channel models often fail to deliver.

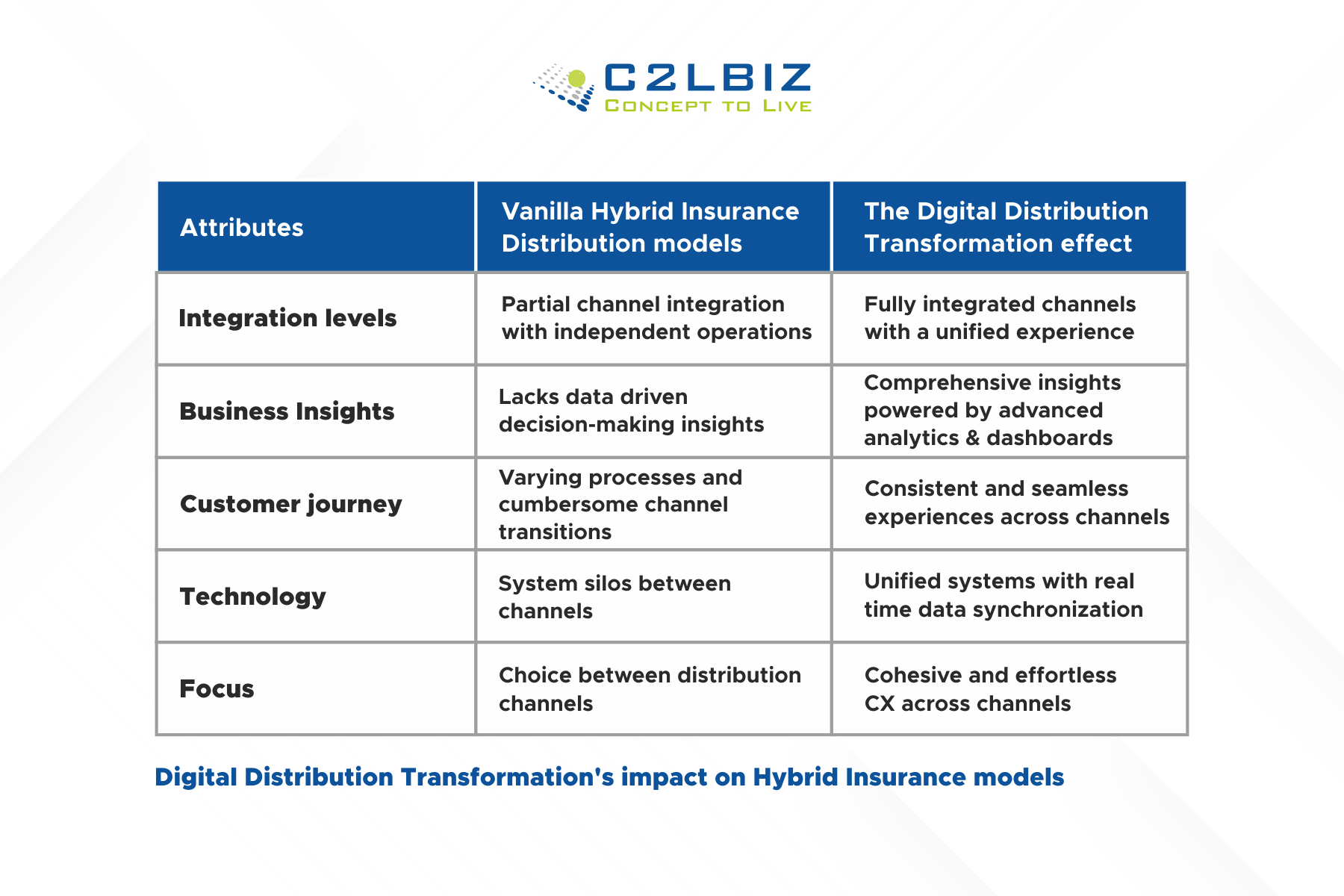

Lack of detailed decision-making insights for insurance leaders is the most major bottleneck in hybrid distribution models. This is where Digital Distribution Transformation accelerates the delivery of seamless customer and producer experiences. The primary ways in which Digital Distribution Transformation contributes to these objectives are listed in Digital Distribution Transformation’s impact on Hybrid Insurance models.

Evolution with extensive insights

End-to-end Digital Distribution Transformation that facilitates seamless cross channel experiences is critical to meet dynamic market needs. Future-ready distribution transformation guarantees efficient partner management and support across channels – throughout the policy lifecycle.

Digital Distribution Transformation equips stakeholders with personalized dynamic dashboards and advanced data analytics that drive business expansion. For instance, the easy availability of comprehensive sales performance insights enables leadership to drive revenue growth across various dimensions and channels.

Advanced analytics enabled by Digital Distribution Transformation boost compensation and performance evaluations. It even enables managers to use creative gamification tools to inspire producers. Proactive alerts regarding potential business or distributor losses ensure timely action to mitigate such events.

Efficiency that scales

Digital Distribution Transformation makes it possible to attract and motivate top-notch partners with the help of bespoke commissions, incentives, payout plans, and high achiever retention. A case in point is how C2L BIZ’s SymbioSys platform empowers our clients to choose from over 5000 distinct rules for KPIs, performance, and compensation options. It effortlessly handles agent compensations at scale with provisions for multiple bank accounts and multi-currency payments.

A powerful sales engagement tool maximizes distributor potential. Digital Distribution Transformation initiatives help insurers streamline the entire sales process across channels using a comprehensive tool. It ensures seamless integration of distributor tools for optimal productivity and cross channel interactions. Insurers can gain holistic information access and extensive insights into compensations, contests, cases, customer data, and team actions to increase producer and leadership productivity.

Digital Distribution Transformation improves customer engagement across channels and resolves objections. Producers can streamline sales by swiftly underwriting cases on the field. It enables them to speed up decision-making with field underwriting and a robust workbench backed by efficient case management. Such rapid decision-making and seamless support for distributors improve policyholder stickiness.

Skillsets that matter

The Digital Distribution Transformation journey necessitates that insurers change their mindsets about the role of distribution. This is why top insurers view distribution as a strategic element rather than just an operational function. Such a shift is essential since Digital Distribution Transformation necessitates overall business transformation rather than minor operational tweaks.

Successful Digital Distribution Transformation initiatives require experts with in-depth insurance industry knowledge. These partners take on an advisory role to ensure long-term and sustainable business transformation.

Utilize the C2L BIZ team’s expertise to drive Digital Distribution Transformation that focuses on real world outcomes. C2L BIZ’s advanced models and professional advisory services leverage our collective wisdom of working with global insurers over the decades. These skillsets guarantee lasting distribution transformation within your organization.

Contact us today for an extensive consultation on how to create and optimize your Hybrid Insurance Distribution strategy. You can also write to us on sales@c2lbiz.com for more information.