The future of Insurance is Digital. Yet, this transition must prioritize how insurance is a “human connect” driven business. Personal relationships drive the business, especially in underinsured markets like India, Philippines, or Thailand. This is why physical channels remain on top globally when it comes to Life and Health insurance.

While digitalization aids insurers, significant challenges remain in terms of the enablement of distribution partners. A look at the APAC market itself reveals that insurers continue to rely on policy numbers instead of a single view of the customer (SVC). Hoarding of customer data at distribution channels due to associated compensation structures further complicates matters. Due to such gaps in the split value chain, insurers are often unable to create optimal omnichannel experiences or highly customized customer offerings.

As we examined in detail in our earlier blog post, Digital Distribution Transformation increases the relevance of physical channels in the digital era. It bridges the gap between physical and digital channels.

Digital Distribution Transformation enables the creation of successful “Phygital” models that enable distribution partners with timely access to relevant information and exceptional customer service capabilities. It ensures that policy buyers get personal connections and customized services, along with the convenience of digital platforms.

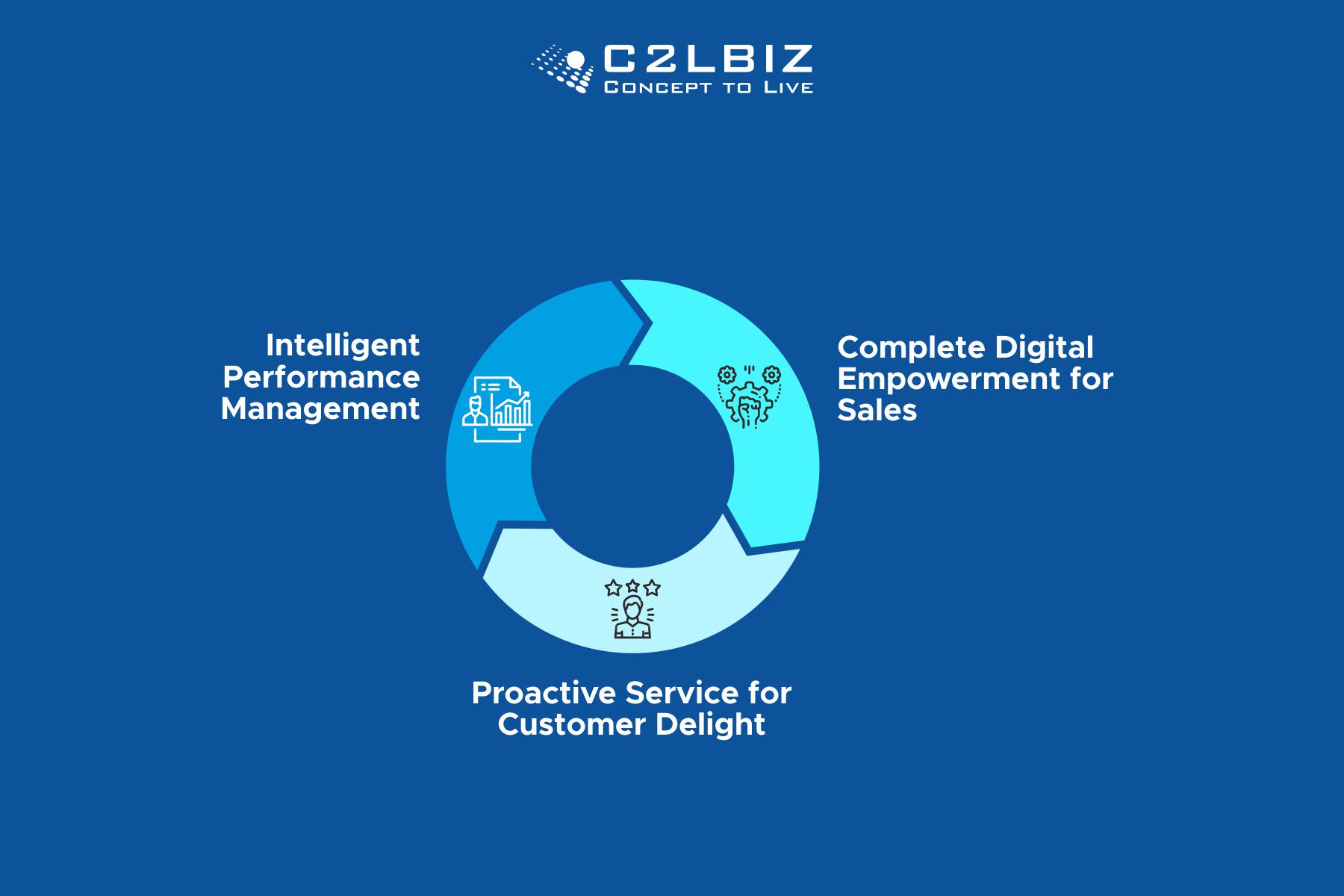

So how do insurers create successful Phygital insurance business models to stay relevant in a rapidly evolving market? Based on our experience working with global insurers, three best practices in combination with Digital Distribution Transformation, as detailed in Figure 1: Reengineering for successful Phygital models are an ideal starting point.

Figure 1: Reengineering for successful Phygital models

1. Ensure complete Phygital empowerment for Sales

The success of Phygital models hinge on digital empowerment and timely intelligence availability to the salesforce. This means that insurers must equip their salesforce with the following prerequisites:

- The right advisory tools for Needs Analysis, Illustrations, Sales Solvers, and Comparisons

- An end-to-end eApp along with digital face to face connectivity options

- Intelligence in the form of Lead Analytics, Activity Tracking, and Collateral Support

- Last mile decision taking capabilities in the form of STP, Field Underwriting, and Counteroffer flows

Digital Distribution Transformation unlocks the full potential of distributors with end-to-end Sales cycle management. At the same time, it enables seamless integration of distributors’ tools for SVC capabilities that deliver optimal omnichannel experiences.

Instant access to holistic information that enhances producer and leadership productivity is a natural benefit of Digital Distribution Transformation. A case in point is the availability of extensive insights into compensations, contests, cases, customer data, and team actions.

Producers can close sales faster with the help of Digital Distribution Transformation, thanks to better customer interactions. The ability to effectively address customer objections or give counteroffers goes a long way on this front. Options like STP or swift Field Underwriting of cases further streamline sales closures.

2. Deliver proactive Omnichannel services for customer delight

Ensuring each customer’s happiness is possible only with a thorough understanding of the person’s needs and wants. It calls for advanced analytics capabilities that deliver:

- Comprehensive addressal of all customer enquiries

- Support for transactions and alterations

- In-force illustrations and Underwriting

- Lifecycle engagement like healthy lifestyle benefits, cross-sell, or upsell options

- Claims streamlining like automated decisions in the case of minor claims

- Decision Support and Tracking for major claims

Digital Distribution Transformation increases insurer competitiveness with faster product launches and sales illustrations on this front. For example, these can be in the form of features like dynamic graphs and solves that enable higher customer engagement and producers’ productivity. Insurers can leverage such capabilities to create easy to understand product variations that fulfil the unique needs of partners and customer segments. Realtime capabilities equip distributors with proactive recommendations like healthy lifestyle options and other product sales possibilities.

On the Claims Management front, Digital Distribution Transformation facilitates end-to-end administration right from Claim Intimation to Claim Payout. This includes defined processes for all stakeholders. Customer satisfaction gets a boost with such interventions since distributors gain access to up to date claim status information. Options like Express Claim option for simple and small value claims, and auto Approval of claim based on Business Rules further enhance the personal connect factor.

3. Establish Intelligent Performance Management

Optimal Performance and Compensation Management underpins the success of leading insurers. Based on our experience, these winning strategies typically involve:

- Tracking and rewarding mechanisms based on performance KPIs

- e-Onboarding that powers organic growth

- Simulations, advanced analytics, and dashboards

- Differentiated compensations and services

- Intelligent self-service portal and apps

- Automated hierarchy-based commissions and payouts

Modern insurers rely on Digital Distribution Transformation to mitigate operational bottlenecks across the value chain. One such example is a quicker onboarding process for partners and producers. Use of a comprehensive digital onboarding platform allows partners to submit documentation online for faster approvals.

Digital Distribution Transformation equips insurers with the capabilities to offer differentiated compensations and expedited payouts. These go a long way in attracting and motivating the right set of distributors. For example, performance-based bonuses or automated payment systems ensure that top performers receive timely recognition and prompt payouts.

Insurers increasingly leverage Digital Distribution Transformation to monitor contest launches, which enhances distributor engagement and incentive programs. It also enables distributors to track their progress in real time using user-friendly digital platforms.

End to end Digital Distribution Transformation improves distributor experiences, productivity, and stickiness. This is essential for the creation of effective Phygital models, especially those that need the ‘human connect’ needs of product lines like Life insurance.

Build successful Phygital models with proven expertise from the Digital Distribution Transformation experts. Reach out to us on sales@c2lbiz.com to create Phygital models that unlock the next stage of revenue growth for your insurance business.