The insurance industry faces significant disruptive distribution and business model threats from multiple fronts. Today, online platforms like Amazon, Google, WeChat, Jio, or Waterdrop deliver one-stop shopping options for insurance and financial products. On the other hand, insurance aggregators like Policy Bazaar and Pasar Polis make their notable alterations to the competitive landscape.

Further threats arise in the form of digital insurers, embedded insurance, peer-to-peer (P2P) insurance, and all new channel models. Such a scenario mandates all new digital readiness strategies from incumbent players. It calls for a reevaluation of the existing distribution models as insurers gear up to adopt “Phygital models” relevant to competitiveness and customer needs.

Physical channels reign supreme

Interestingly, physical channels still dominate despite all the insurance market disruptions by new age competition. This dominance is evident from LIMRA’s recent U.S. Individual Annuity Sales Survey.

LIMRA’s research indicates a record year for total U.S. annuity sales, at a record US$ 385.4 billion. This notable 23% year-on-year increase has been driven by independent channels that contributed 41% of the total annuity sales. These channels, which consist of independent agents and broker-dealers, saw a collective growth of 29% from their 2022 figures.

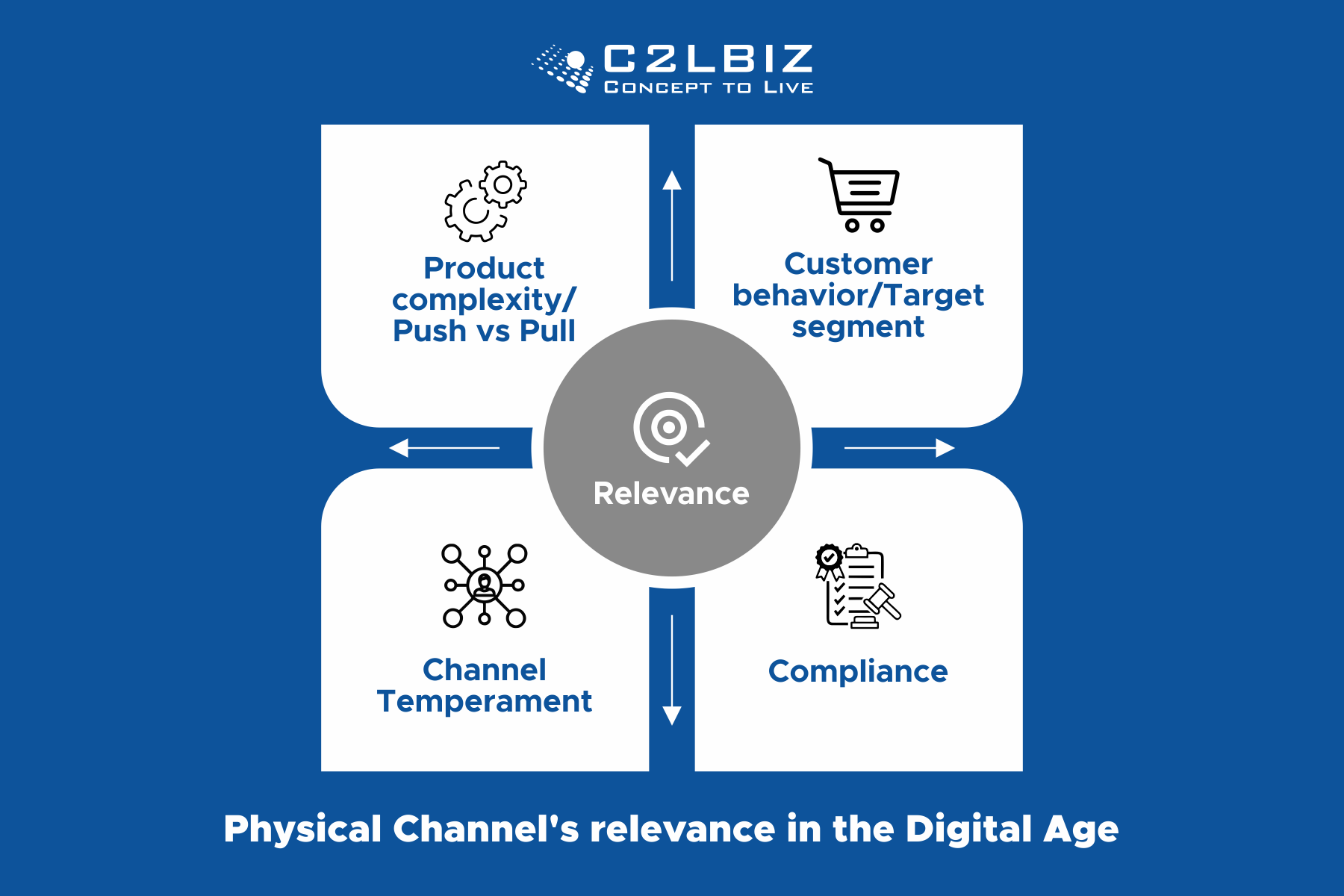

Now the question arises as to the ongoing relevance of physical channels in a competitive insurance market. Based on our experience with C2L BIZ’s client success stories, this requires insurers to occupy a sweet spot as displayed in Figure 1: Sustaining physical channel relevance in the digital age.

Figure 1: Sustaining physical channel relevance in the digital age

Today’s insurers must tread the fine line between relevant product mixes based on an optimal fulfilment of customer needs, channel temperament, and compliance requirements. Irrespective of whether it is an agent, broker, IFA, or Bancassurance, these attributes are essential to sustain the relevance of physical channels.

Evaluate Digital Readiness

Digital transformation of the split value chain is a constantly shifting goal post for many insurers when it comes to physical channels. This significantly impacts each channel’s significance. It is high time that insurers assess their readiness to gauge their true digital readiness to power physical channels.

Digital readiness for creation of successful Phygital insurance business models require an in-depth assessment of:

Product complexity and type: Can you quickly and consistently offer “made to measure” products or services with your present digital capabilities? These must be possible at unique price points irrespective of whether it is a bundled or unbundled offering. Also consider the push or pull nature of the specific product as part of this exercise.

Interoperability: Modern insurers face multiple challenges due to the split value chain. For example, how fast can you grow using your existing digital platforms when it comes to partner onboarding, underwriting, distributor management, or case management? Also evaluate aspects like availability of advanced business insights, partner evaluation metrics, and advanced data analytics for key stakeholders at this stage.

Future-ready adaptability: Is your insurance business ready to take on new age business models without faltering? Thoroughly gauge how you can innovate and adapt to competition (emerging or otherwise) on this front.

Answers to the above questions will paint a true picture of your insurance business’ digital readiness to meet the physical channels’ needs. Glaring inconsistencies in your distribution management strategies often emerge at this point. This is where Digital Distribution Transformation emerges as the answer to ensure consistent business and revenue growth. Creation of effective Phygital models is a salient benefit of this approach.

Time for sustainable business change

Seamless Digital Distribution Transformation across the value chain is important for your business to meet new age market and customer needs. Such future-ready transformation ensures optimal partner recruitment, management, and support at each stage of the policy lifecycle.

Digital Distribution Transformation of your insurance business ensures the creation of Phygital models that deliver the following benefits:

- Complete Digital Empowerment for Sales with comprehensive advisory tools, intelligence, field underwriting, and last mile decision-making capabilities

- Proactive Service for Customer Delight with the help of advanced analytics, customer support, lifecycle engagement, and claims management capabilities

- Intelligent Performance Management with differentiated compensations, KPI tracking, e-Onboarding, simulations, and partner self-service portals

At C2L BIZ, we believe that true Digital Distribution Transformation requires the synergies of sustainable architecture, the use of technology as an enabler, and optimal implementation. This is essential to create a truly “Digital” way of doing business.

True Digital Distribution Transformation improves distributor experiences, productivity, and stickiness. It maximizes the relevance of your business’ all-important lifelines—the physical channels. This is essential to create effective Phygital models, especially those that meet the ‘human connect’ needs of product lines like Life insurance.

Maximize the potential of your Physical Channels with help from the Digital Distribution Transformation experts. Contact us at sales@c2lbiz.com to create Phygital models that unlock the next stage of revenue growth for your insurance business.